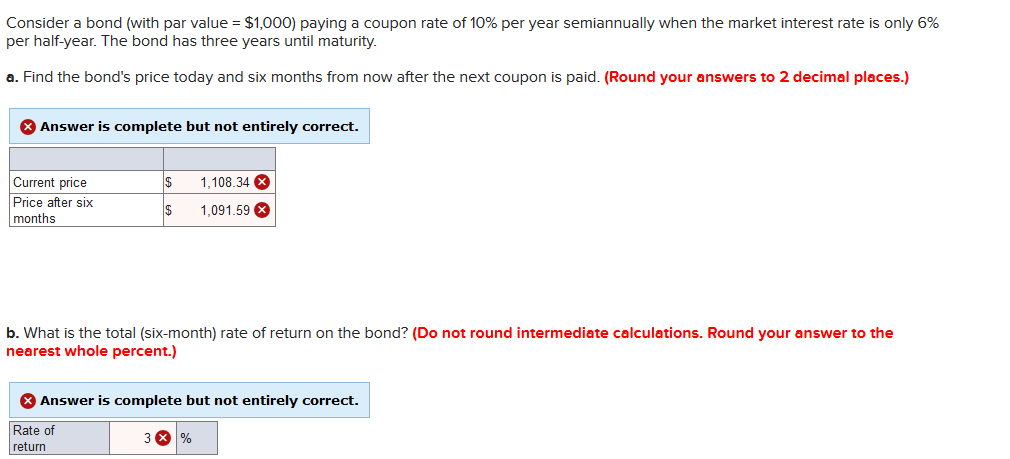

41 consider a bond paying a coupon rate of 10 per year semiannually when the market

courseworkhero.co.ukCoursework Hero - We provide solutions to students We provide solutions to students. Please Use Our Service If You’re: Wishing for a unique insight into a subject matter for your subsequent individual research; quizlet.com › 293552844 › finance-final-ch-10-11Finance Final Ch. 10-11 Flashcards | Quizlet Dardanel Foods' (DF) balance sheet shows a total of $25 million long-term debt with a coupon rate of 8.50%. The yield to maturity on this debt is 8.00%, and the debt has a total current market value of $27 million. The balance sheet also shows that the company has 10 million shares of stock, and the stock has a book value per share of $5.00.

achieveressays.comAchiever Essays - Your favorite homework help service You have 10 days to submit the order for review after you have received the final document. You can do this yourself after logging into your personal account or by contacting our support. Prompt Delivery and 100% Money-Back-Guarantee

Consider a bond paying a coupon rate of 10 per year semiannually when the market

fountainessays.comFountain Essays - Your grades could look better! After paying, the order is assigned to the most qualified writer in that field. The writer researches and then submits your paper. The paper is then sent for editing to our qualified editors. After the paper has been approved it is uploaded and made available to you. You are also sent an email notification that your paper has been completed. successessays.comSuccess Essays - Assisting students with assignments online $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. ... We offer the lowest prices per page in the industry ... quizlet.com › ca › 278831791EC140 - Macroeconomics : Chapter 30.3 Flashcards | Quizlet A good example of an outcome that could lead to "hysteresis" in the labour market is a. New entrants to the labour market have a high rate of unemployment due to technological change. b. New entrants to the labour market have difficulty finding jobs, and as a result have a higher rate of unemployment throughout their working lives.

Consider a bond paying a coupon rate of 10 per year semiannually when the market. quizlet.com › ca › 278831791EC140 - Macroeconomics : Chapter 30.3 Flashcards | Quizlet A good example of an outcome that could lead to "hysteresis" in the labour market is a. New entrants to the labour market have a high rate of unemployment due to technological change. b. New entrants to the labour market have difficulty finding jobs, and as a result have a higher rate of unemployment throughout their working lives. successessays.comSuccess Essays - Assisting students with assignments online $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. ... We offer the lowest prices per page in the industry ... fountainessays.comFountain Essays - Your grades could look better! After paying, the order is assigned to the most qualified writer in that field. The writer researches and then submits your paper. The paper is then sent for editing to our qualified editors. After the paper has been approved it is uploaded and made available to you. You are also sent an email notification that your paper has been completed.

Post a Comment for "41 consider a bond paying a coupon rate of 10 per year semiannually when the market"