38 yield of zero coupon bond

The Zero Coupon Bond: Pricing and Charactertistics This means if we pay something around $72 (100-28) on December 1, 1996 for the $100 coupon due on December 1, 2001, we will earn something around 30% over the period or 6% a year. Pulling out our trusty bond calculator, we can actually do the calculation. At a semi-annual yield of 5.6%, the price works out to be $75.91. en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM; par: YTM = current yield = coupon yield. For zero-coupon bonds selling at a discount, the coupon yield and current yield are zero, and the YTM is positive. See also. Adjusted current yield; References

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Yield of zero coupon bond

› financial › bond-yieldBond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 15 hours ago, on 6 Oct 2022 Frequency daily Description These yield curves... Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period

Yield of zero coupon bond. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Zero coupon bonds can work to your advantage, if used judiciously and in tandem with your investment objectives. Without any intermittent coupon payments, the calculation of yield to maturity of a zero-coupon bond is as follows: (Face value/ current market price) * (1/years to maturity) - 1 Features of Zero-Coupon Bond › bonds › 07Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · At issuance, a bond's yield will equal the coupon rate if the bond was issued at par value. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond. Fixed Income. Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive... › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity is an essential investing concept used to compare bonds of different coupons and times until maturity. Without accounting for any interest payments, zero-coupon bonds always... Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The zero coupon bond effective yield formula shown up top takes into consideration the effect of compounding. For example, suppose that a discount bond has five years until maturity. If the number of years is used for n, then the annual yield is calculated. Considering that multiple years are involved, calculating a rate that takes time value of money and compounding into consideration is needed. An investment that pays 10% per year is not equivalent to a 10 year discount bond that pays a ... Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield).

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Primer: Par And Zero Coupon Yield Curves - Bond Economics Par and zero coupon curves are two common ways of specifying a yield curve. Par coupon yields are quite often encountered in economic analysis of bond yields, such as the Fed H.15 yield series. Zero coupon curves are a building block for interest rate pricers, but they are less commonly encountered away from such uses. Zero Coupon Bonds - Financial Edge Zero coupon bonds are a type of debt instrument issued by companies and governments to raise capital to fund their operations and growth; ... What is the expected yield to maturity on this bond? (1/3)-1 = 11.3%. The bondholder expects a return of 11.3%. Share this article. Test Yourself.

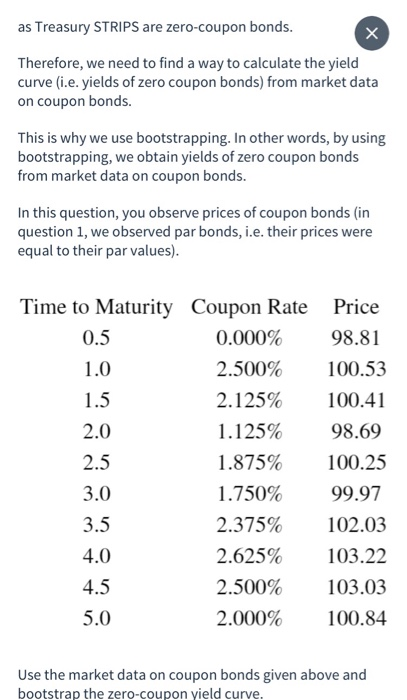

The construction of a zero-coupon yield curve by the method of ... To calculate the zero-coupon rate for the 2-year maturity, we will strip security D into two zero-coupons : the first with a nominal amount of 3.5 ( the 1st year coupon) and a maturity of one year, and the second with a nominal amount of 103.5 (2nd year coupon plus redemption of the bond's nominal) and a maturity of two years.

How to Calculate the Yield of a Zero Coupon Bond Using Forward Rates? Then now we just subtract 1 from each side so that's gonna give us 0.066 is equal to our yield to maturity on a five-year zero-coupon bond and another way of expressing that 0.066 is 6.6% that's the same thing it's just our way of expressing that decimal.

› knowledge › zero-coupon-bondWhat are Zero-Coupon Bonds? (Characteristics and Examples) Zero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price.

Zero coupon bond interest rate - cvbi.magicears.shop The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 +. Zero coupon bonds are sensitive to interest rate fluctuations. The price you can get on the open market will be determined by current interest rates.

How to Calculate the Yield of a Zero Coupon Bond? - Counting Accounting So for example let's say that you bought a bond for $95,238.The face value of the bond was $100,000. So because it's a zero-coupon bond that we're talking about there's not going to be any periodic interest payments or anything like that it's just a simple 1-year bond where you pay $95,238 in a year from now and get $100,000 returned to you.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a 20 ...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide The annualized rate which they receive on the zero-coupon bond is the same rate at which their money will be automatically reinvested. This is the reason that zero-coupon bonds become extremely popular especially during periods when the market yield is high. This is because investors want to lock this high yield over extended periods of time.

home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury Sep 30, 2010 · NOTICE: See Developer Notice on February 2022 changes to XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are ...

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-09-30 about 10-year, bonds, yield, interest rate, interest, rate, and USA.

Zero Coupon Yield Curve - The Thai Bond Market Association Zero Coupon Yield Curve 0 10 20 30 40 50 60 TTM (yrs.) 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 Yield (%) ThaiBMA Zero Coupon Yield Curve as of Thursday, September 1, 2022 ThaiBMA Government Bond Yield Curve as of 01 September 2022 Export to Excel Remark: 1.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

What Is a Zero Coupon Yield Curve? - Smart Capital Mind The reason for constructing a zero coupon yield curve is for use as a basic tool in determining the price of many fixed income securities. A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity.

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period

US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 15 hours ago, on 6 Oct 2022 Frequency daily Description These yield curves...

› financial › bond-yieldBond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below:

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/14-Figure3-1.png)

Post a Comment for "38 yield of zero coupon bond"