38 ytm and coupon rate

BondBloxx CCC Rated USD High Yield Corporate Bond ETF - BondBloxx® ETF Yield to Maturity: The discount rate that equates the present value of a bond's cash flows with its market price (including accrued interest). The Fund Average Yield to Maturity is the weighted average of the fund's individual bond holding yields based on Net Asset Value ('NAV'). ... Average Coupon: The average coupon rate of the ... AMAZON.COM INC.DL-NOTES 2017(17/27) Bond - Insider The Amazon.com Inc.-Bond has a maturity date of 8/22/2027 and offers a coupon of 3.1500%. The payment of the coupon will take place 2.0 times per biannual on the 22.02.. At the current price of 98 ...

Municipal Bonds Market Yields | FMSbonds.com Municipal Market Yields. The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. These rates reflect the approximate yield to maturity that an investor can earn in today's tax-free municipal bond market as of 05/02/2022.

Ytm and coupon rate

Egypt Government Bonds - Yields Curve The Egypt 10Y Government Bond has a 17.430% yield. 10 Years vs 2 Years bond spread is 151 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 11.25% (last modification in May 2022). The Egypt credit rating is B, according to Standard & Poor's agency. 10-Year T-Note Overview - CME Group Specs. Margins. Calendar. Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis ... Research Guides: How do I use Bloomberg: Fixed Income For example, enter MSFT and select the bond, e.g. MSFT 2.95 06/01/14, that you want more information. A bond ticker symbol is made up of three main parts: MSFT =Ticker Symbol of Microsoft Corporation, 2.95 =Coupon Rate, 06/01/14 =Maturity. If you know the ticker symbol and command code, you can go directly to the information that ...

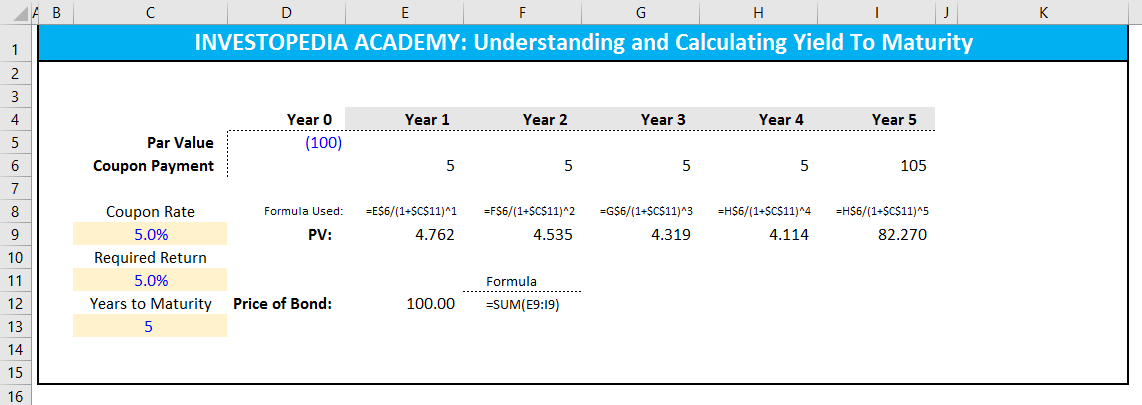

Ytm and coupon rate. Bond Yield Definition | U.S. News Coupon rate = annual interest payment ÷ bond face value x 100 For example, a $10,000 bond that pays $500 interest per year has a coupon rate of 5%. However, coupon rates do not account for the fact... Current Rates | Edward Jones All rates expressed as yield to maturity as of 7/21/2022 unless otherwise indicated. Yield and market value will fluctuate if sold prior to maturity, and the amount received from the sale of these securities may be less than the amount originally invested. Daily Treasury Yield Curve Rates - YCharts Secured Overnight Financing Rate Data: Jul 22 2022, 08:00 EDT: Bank of Canada Interest Rates: Jul 22 2022, 08:30 EDT: Bank of America Merrill Lynch: Jul 22 2022, 09:00 EDT: Canadian Overnight Repo Rate Average: Jul 22 2022, 10:00 EDT: H.15 Selected Interest Rates: Jul 22 2022, 16:15 EDT: Euro Yield Curves: Jul 22 2022, 17:00 EDT: Daily Treasury ... Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... Categories > Money, Banking, & Finance > Interest Rates > Treasury Constant Maturity Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis (DGS10) 2022-07-21: 2.91 | Percent | Daily | Updated: 3:25 PM CDT

LiveLive Market Watch - Bonds Trade In Capital Market, NSE India YTM computation is based on the Corporate Action dates available with the Exchange. Download the example for understanding of yield calculation Disclaimer: The information and content (collectively 'information') provided herein are provided by NSE as general information. US 10 year Treasury Bond, chart, prices - FT.com European shares and US futures edge lower as Snap results add to gloomy outlook Jul 22 2022; ECB raises rates for first time in more than a decade Jul 21 2022; Nomura co-head of investment banking foresees huge rise in ESG dealmaking Jul 21 2022; Drugmaker Eisai secures ESG money by linking investments to value Jul 21 2022; Italian bonds sell off after Draghi resigns and ECB boosts rates Jul ... iShares Interest Rate Hedged U.S. Aggregate Bond ETF | AGRH YTM (%) FX Rate Maturity Coupon (%) Mod. Duration Yield to Call (%) Yield to Worst (%) Real Duration Real YTM (%) Accrual Date Effective Date Detailed Holdings and Analytics. Holdings (Supplemental Information) Cash Flows; Holdings are subject to change. WALMART INC. Bond | Markets Insider The Walmart Inc.-Bond has a maturity date of 8/15/2037 and offers a coupon of 6.5000%. The payment of the coupon will take place 2.0 times per biannual on the 15.02.. At the current price of 131 ...

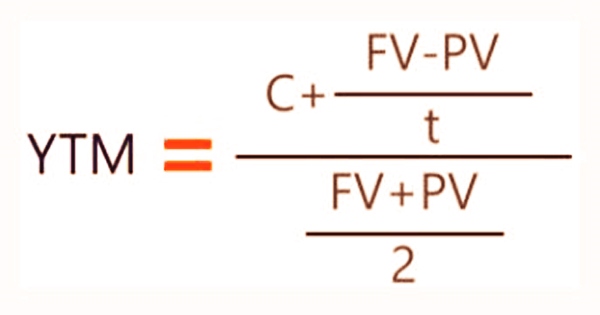

What is the difference between Coupon Rate and Yield of Maturity? The rate at which a bond's investor receives interest payments is known as the coupon rate. It is a percentage that represents the annual interest rate that the bond pays in relation to its face value. The coupon rate is comparable to fixed-income government and corporate bonds, in which the bond's issuer receives yearly interest payments. iShares® iBonds® Dec 2032 Term Treasury ETF | IBTM NAV as of Jul 22, 2022 $25.26 1 Day NAV Change as of Jul 22, 2022 0.30 (-%) Fees as stated in the prospectus Expense Ratio: 0.07% Overview Performance & Distributions Fund Facts Sustainability Characteristics Fees Holdings Literature Performance Growth of Hypothetical $10,000 Performance data is not currently available Distributions Synchrony Financial: The Consumer Is Still Spending Synchrony also has a preferred issue with a 5.625% coupon now trading at $19.59 for a current yield of 7.25%. The preferred is callable starting on 11/15/2024 at par value of $25. Rates Coupon Price YTM YTC YTW Settle Date Maturity Date Spec Coupon Comments New Deal; Security Rates. Download PDF to view rates. Download PDF . ... Posted rate for the previous quarter is declared by the Board of Directors at the meeting held on quarter-end months and is paid out quarterly on an actual/365 day basis. The posted rate for the ...

Preferred Stock - YTC Calculator Calculate Yield to Call : Click the Year to select the Call Date, enter coupon call and latest price then Calculate

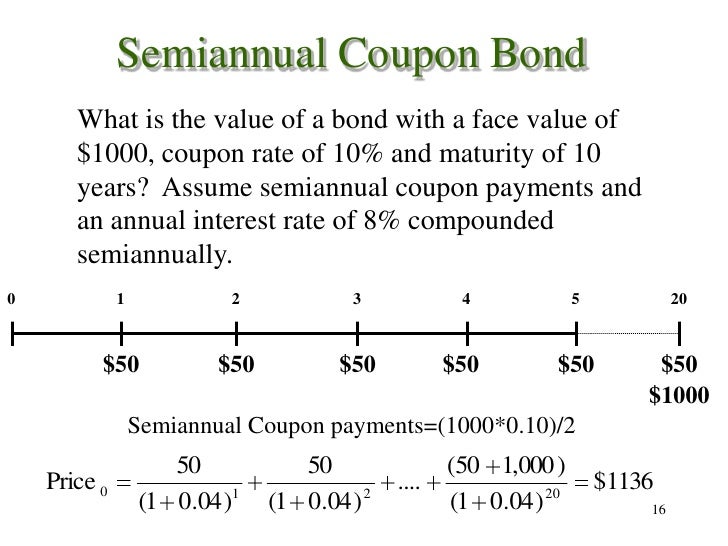

Kelvin Wiredu, [20/07/2022 05:57] 1. Oil Well Supply | Chegg.com The coupon rate is 20% to be paid semi-annually. The 5-year risk-free rate is 20% p.a. It is estimated that the risk premium appropriate to company Y is 6 percentage points (10 Marks). 8. Briefly describe the following types of bond for 5 marks each i. Callable bonds and under what circumstances would the issuer make a call ii. Eurobonds iii.

Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... The coupon rate was set at 0.625%, the highest coupon for a new TIPS in three years. In fact, this auction broke a string of 15 consecutive auctions of 9- to 10-year TIPS with a coupon rate of 0.125%, the lowest the Treasury will go for a TIPS.

iShares Interest Rate Hedged U.S. Aggregate Bond ETF | AGRH Benchmark Index BlackRock Interest Rate Hedged U.S. Aggregate Bond Index. Bloomberg Index Ticker USIRAGG. Shares Outstanding as of Jul 13, 2022 200,000. Distribution Frequency Monthly. Premium/Discount as of Jul 12, 2022 0.09%. CUSIP 46431W531. Closing Price as of Jul 12, 2022 25.26. 30 Day Avg. Volume as of Jul 12, 2022 339.00.

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.414% yield. 10 Years vs 2 Years bond spread is 101.2 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.90% (last modification in June 2022). The India credit rating is BBB-, according to Standard & Poor's agency.

ICE BofA US High Yield Index Effective Yield - St. Louis Fed Each security must have greater than 1 year of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $100 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify ...

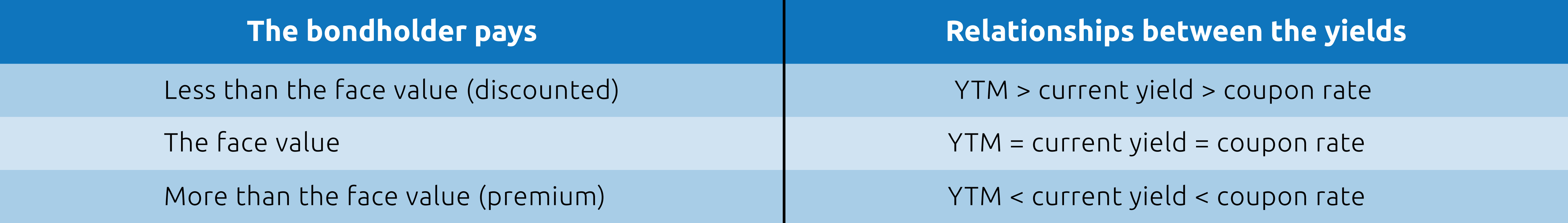

The Relationship Between Bond Prices and Interest Rates According to the Securities and Exchange Commission's bulletin on interest rate risk, bond prices also have an inverse relationship with YTM rates. The yield will match the coupon rate when a bond...

Post a Comment for "38 ytm and coupon rate"