39 coupon paying bond formula

Coupon Rate Formula - WallStreetMojo The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Bond Valuation Definition - Investopedia Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ...

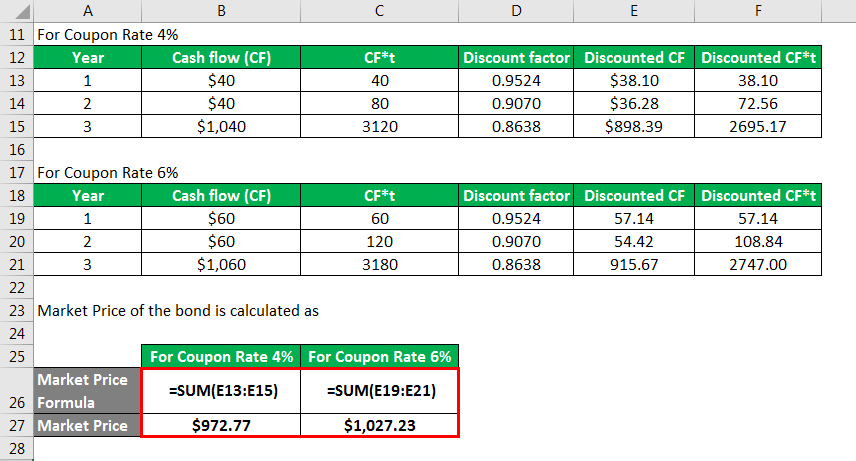

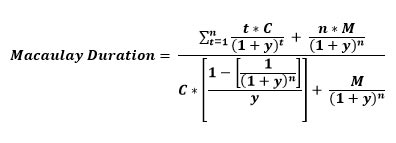

Coupon paying bond formula

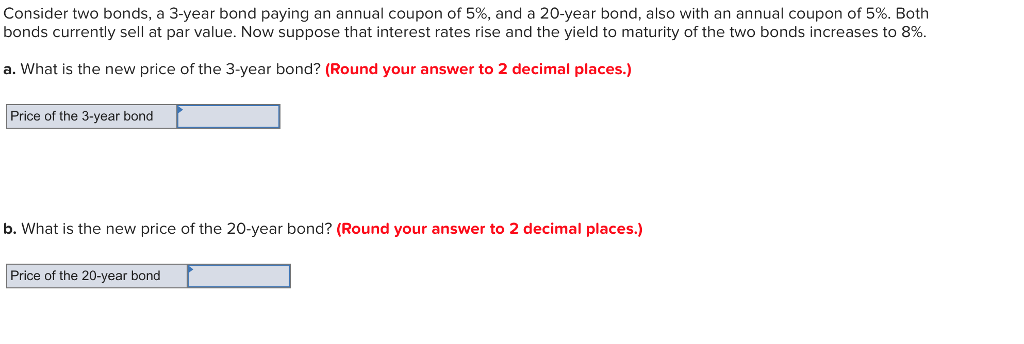

Coupon Bond - investopedia.com The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000... Zero Coupon Bond (Definition, Formula, Examples, Calculations) Unlike current yield, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of the term of a bond. read more is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Bond Formula | How to Calculate a Bond | Examples with ... Mathematically, the formula for coupon bond is represented as, Coupon Bond Price = C * [ (1- (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] where, C = Annual Coupon Payment F = Par Value at Maturity r = YTM n = Number of Coupon Payments in A Year t = Number of Years until Maturity

Coupon paying bond formula. How to use the Excel COUPNCD function | Exceljet Historically, bonds were printed on paper with detachable coupons. The coupons were presented to the bond issuer by the bondholder to collect periodic interest payments. The Excel COUPNCD function returns the next coupon date after the settlement date. The settlement date is the date the investor takes possession of a security. What Is the Coupon Rate of a Bond? The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Coupon Bond - Guide, Examples, How Coupon Bonds Work c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Thank you for reading CFI's guide on Coupon Bond. corporatefinanceinstitute.com › resourcesEffective Interest Method - Overview, Uses, Formula The formula used to calculate the effective interest rate is as follows: Where: i = The bond’s coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. n = The number of coupon payments per year (i.e., if coupon payments are received monthly, then n would be 12)

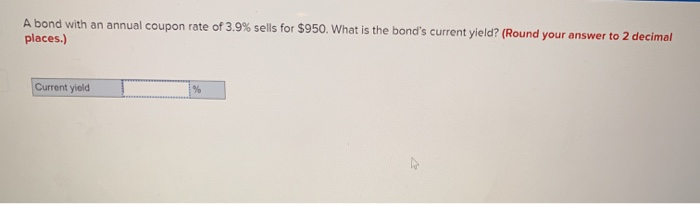

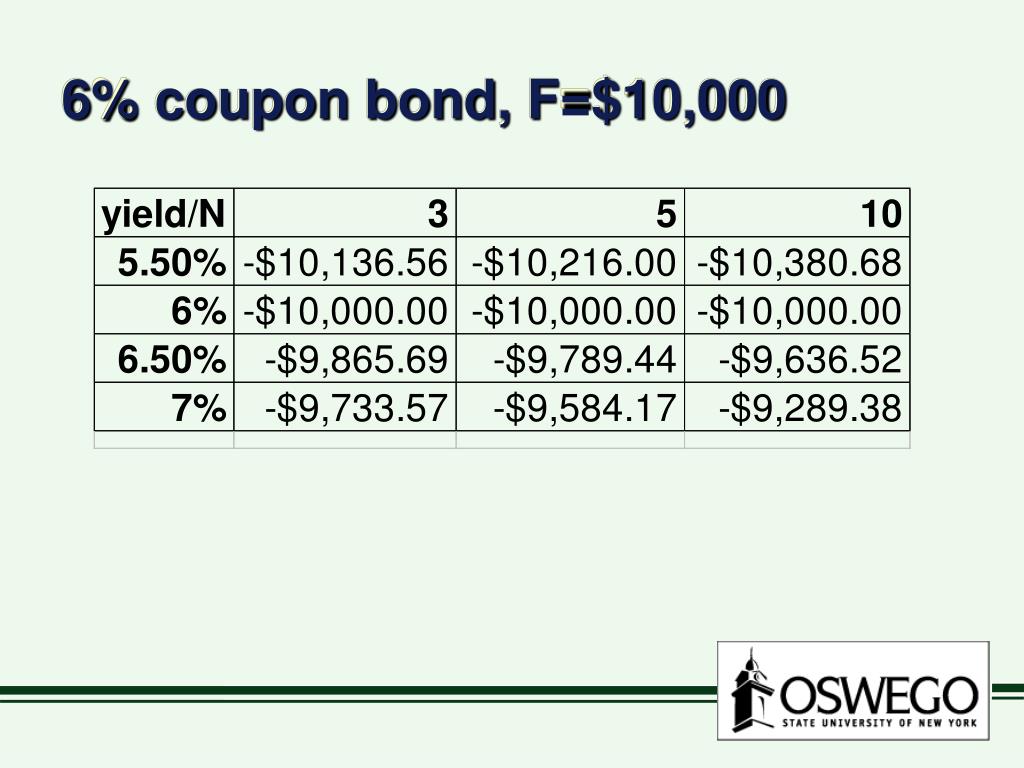

Calculation of the Value of Bonds (With Formula) If the coupon rate of interest on a Rs. 1000 per value perpetual bond is 7% what is its current yield if the bond's market price is Rs. 700? Current yield = 70/700 = 10% If the bond sells for Rs. 1400 the current yield will be 5%. (2) Yield on bonds with maturity period: Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Par Bond - Overview, Bond Pricing Formula, Example A bond with a face value of $100 and a maturity of three years comes with a coupon rate of 5% paid annually. The current market interest rate is 5%. Using the bond pricing formula to mathematically confirm that the bond is priced at par, Shown above, with a coupon rate equal to the market interest rate, the resulting bond is priced at par. Zero Coupon Bond Yield: Formula, Considerations, and ... Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ...

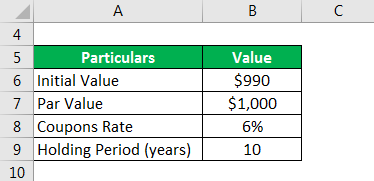

What is a Coupon Payment? - Definition | Meaning | Example Despite the attractive return, he decides to purchase $10,000 of the US Treasury Bond. Now, how will this affect his $10,000 principal? Using the 3% rate of return on the bond, Mark calculates that the bond's coupon payment formula, or annual payment to him, is ($10,000 x (0.03)) = $300, or $3,000 overall. Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield. Coupon Rate Formula | Simple-Accounting.org The coupon rate, or coupon payment, is the yield the bond paid on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity. The prevailing interest rate directly affects the coupon rate of a bond, as well as its market price.Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000 ... Bond Price Calculator IF c <> r AND Bond price < F then the bond should be selling at a discount. Example of a result. Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%.

› amortization-formulaAmortization Formula | Calculator (With Excel template) Amortization Formula in Excel (With Excel Template) Amortization Formula. Amortization refers to paying off debt amount on periodically over time till loan principle reduces to zero. Amount paid monthly is known as EMI which is equated monthly installment. EMI has both principal and interest component in it which is calculated by amortization ...

How Can I Calculate a Bond's Coupon Rate in Excel? In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments...

Accrued Interest Calculator Excel / Accrued Interest Formula | Calculator (Examples with Excel ...

Bond Pricing Formula | How to Calculate Bond Price? | Examples The coupon payment during a period is calculated by multiplying the coupon rate and the par value and then dividing the result by the frequency of the coupon payments in a year. The coupon payment is denoted by C. C = Coupon rate * F / No. of coupon payments in a year

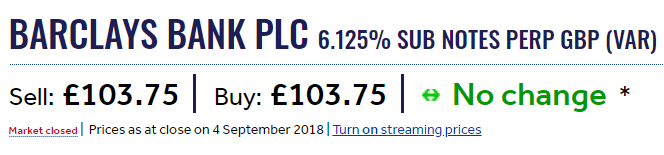

Coupon Rate Formula | Calculator (Excel Template) Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Bond Yield Formula | Calculator (Example with Excel Template) Annual Coupon Payment is calculated using the formula given below Annual Coupon Payment = Coupon Rate * Par Value Annual Coupon Payment = 5% * $1,000 Annual Coupon Payment = $50 The other cash flow to be received at the end of three years in the form of par value is $1,000. Popular Course in this category

Coupon Bond Formula | Examples with Excel Template Mathematically, the formula for coupon bond is represented as, Coupon Bond = ∑ [ (C/n) / (1+Y/n)i] + [ F/ (1+Y/n)n*t] or Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity

Bond Yield Formula | Step by Step Calculation & Examples The annual coupon payment is calculated by multiplying the bond's face value with the coupon rate. Calculate Bond Yield Let us understand the bond yield equation under the current yield in detail. Bond Yield Formula = Annual Coupon Payment / Bond Price Bond Prices and Bond Yield have an inverse relationship

How to Calculate a Coupon Payment: 7 Steps (with Pictures) If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment is .08 * 1000 or $80.

Bond Pricing Formula |How to Calculate Bond Price? Bond pricing is the formula used to calculate the prices of the bond being sold in the primary or secondary market. Bond Price = ∑ (Cn / (1+YTM)n )+ P / (1+i)n Where n = Period which takes values from 0 to the nth period till the cash flows ending period Cn = Coupon payment in the nth period YTM = interest rate or required yield

Bond Pricing - Formula, How to Calculate a Bond's Price A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Zero-coupon bonds Original Issue Discount (OID) An original issue discount (OID) is a type of debt instrument. Often a bond, OID's are sold at a lower value than face value when issued are typically priced lower than bonds with coupons.

How to Calculate Present Value of a Bond - Pediaa.Com What is a bond. A bond is a financial instrument that is issued for a specific period with the purpose of borrowing money. When the bond is issued, it promises the holder, to pay a fixed sum of interest based on the predefined interest rate (coupon rate) at specified dates, usually, semi-annually, annually,etc. until it matures and it repays the principle amount at the maturity.

Coupon Bond Formula | How to Calculate the Price of Coupon ... Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

Bond Formula | How to Calculate a Bond | Examples with ... Mathematically, the formula for coupon bond is represented as, Coupon Bond Price = C * [ (1- (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] where, C = Annual Coupon Payment F = Par Value at Maturity r = YTM n = Number of Coupon Payments in A Year t = Number of Years until Maturity

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Unlike current yield, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of the term of a bond. read more is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19

Coupon Bond - investopedia.com The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000...

Post a Comment for "39 coupon paying bond formula"